Fed up with traditional banks that seem stuck in the past? Enter ANNA Money, the business account designed for modern entrepreneurs like you. With its seamless blend of finance and tech, ANNA offers a refreshing alternative to the cumbersome processes of old-school banking.

Imagine managing your invoices, expenses, and taxes all in one place, while an AI-powered assistant helps keep your finances in check. ANNA Money isn’t just another business account; it’s a smart solution tailored to the needs of freelancers, startups, and small business owners across the UK. Ready to streamline your financial management? Let’s dive into what makes ANNA Money the game-changer you’ve been waiting for.

Overview of ANNA Money Business Account

ANNA Money offers a unique blend of technology and financial management for UK entrepreneurs. Designed for freelancers, startups, and small business owners, it combines advanced tools with simple usability.

- AI-Powered Assistant: ANNA’s assistant handles invoices, expenses, and taxes effortlessly. Ever wonder how much time you can save with automated invoicing? This AI has got you covered.

- Seamless Integration: Link your ANNA account with other financial tools. It syncs with accounting software, saving you from juggling multiple platforms.

- Expense Management: Easily track expenses and categorise them for better financial insight. Should you need to locate last month’s spending, it’s all in one place.

- Instant Notifications: Receive real-time updates on transactions. You’ll always know what’s happening in your account without even logging in.

- Secure Transactions: Security measures ensure your data remains safe. This feature assures you that your financial information is protected.

Pricing and Fees

Understanding the costs linked to your ANNA Money business account is crucial for making an informed decision.

- Account Fees: ANNA Money offers competitive pricing plans. The basic account might suit startups, while more comprehensive plans cater to growing businesses.

- Transaction Costs: Some transactions incur fees. Detailed information is available in ANNA’s pricing guide, helping you avoid unexpected charges.

- Foreign Exchange: Foreign transactions might come with additional fees. Checking these in advance can help manage international dealings.

- Cash Withdrawals: There are limits and fees for cash withdrawals. ANNA keeps these transparent so you’re never caught off guard.

Curious about how ANNA Money can simplify your business transactions and expenses? Dive into their features and see the benefits for yourself.

Setting Up Your ANNA Money Business Account

You’ll need specific documents to set up your ANNA Money business account. Have these ready:

- Proof of identity, such as a passport or driving licence

- Proof of address, like a utility bill or bank statement

- Business details, including registration number and company address

Having these documents handy speeds up the process. Got them ready? You’re already halfway. Keep going.

Step-by-Step Account Opening Process

Let’s break down the ANNA Money account setup. It’s easier than you think.

- Download the ANNA App: Start by downloading the ANNA Money app from the App Store or Google Play.

- Create an Account: Open the app and follow the prompts to create an account. Enter your email and set a password.

- Verify Identity: Next, the app will ask for identity verification. Use your passport or driving licence.

- Submit Proof of Address: Upload a recent utility bill or bank statement. Make sure it’s less than three months old.

- Enter Business Information: Input your business registration number and address. Double-check for accuracy.

- Review and Confirm: Revisit your details. Everything correct? Confirm and submit your application.

After submission, ANNA Money processes your details. You’ll receive a confirmation. Simplicity defines the essence of setting up your ANNA Money business account.

Usability and Mobile App Features

Mobile App Functionality

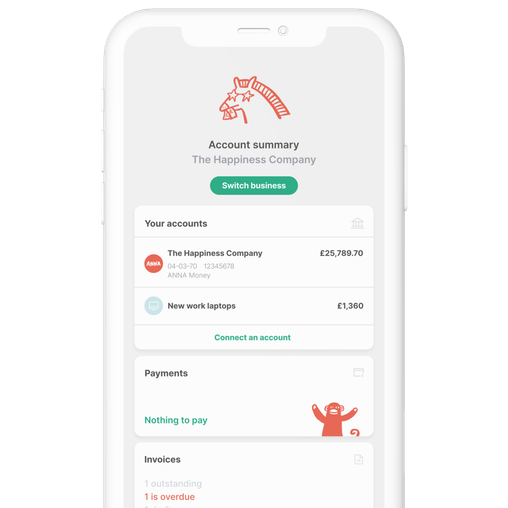

With the ANNA Money app, your business transactions are smoother and faster. The app’s user-friendly interface takes the confusion out of managing finances. You can easily figure out through the app, finding everything you need without hassle. The dashboard might display your account balance, recent transactions, and pending invoices. This layout makes it clear where your money’s going.

You can issue invoices directly from the app. Select a client from your contact list, fill in the details, and send it in seconds. The app could also help with expense tracking. Use it to snap photos of receipts and categorise them on the spot. The AI assistant is like having a personal finance manager in your pocket. It might give you reminders about upcoming bills or notify you when a payment comes through. And with instant notifications, you stay updated on all your transactions.

Additional Tools and Integrations

ANNA Money offers tools that make your business life easier. The app supports seamless integrations with accounting software like Xero and QuickBooks. These integrations mean your financial data syncs effortlessly. No need to enter details manually—just connect and go.

The currency converter might be especially handy if dealing with international clients. It lets you know how much you’re charging or paying in different currencies. You could also appreciate the tax calculation tool that estimates your tax obligations, helping you avoid any nasty surprises come tax season.

The app’s collaboration features enable smoother teamwork. Share access with your accountant so they can view transaction records without needing to email documents back and forth. This ease of access promotes a more efficient workflow.

ANNA Money’s usability extends beyond basic banking, embedding itself into your business processes. From sending invoices and tracking expenses to integrating with key financial tools, ANNA Money turns financial management into a seamless experience.

Security and Customer Support

Security is a priority for ANNA Money. Rigorous protocols ensure your business finances remain secure. Your data undergoes encryption, safeguarding it from unauthorised access. State-of-the-art technology continuously monitors activities for suspicious behaviour, acting swiftly if any anomalies appear.

Two-factor authentication shields your account by requiring a secondary verification step. Biometric identification through fingerprints or facial recognition enhances security further. When payments are made, the system employs secure channels to prevent interception, ensuring your transactions proceed safely. It’s clear ANNA Money invests in keeping your resources secure so you can focus on running your business without concern.

Availability of Customer Service

ANNA Money takes customer support seriously. A dedicated team can assist you 24/7. Issues get resolved swiftly, minimising disruption. Does something feel off or need clarification? Reach out via the in-app chat, phone, or email. Prompt responses aim to provide answers without delay.

You might face a technical challenge, need help figuring features, or have a banking query. Regardless, trained support advisers ensure you’re not left in the dark. Guidance includes helpful tips and user tutorials, enabling self-service when feasible.

Any feedback or encountered problems can lead to service improvements because ANNA Money values user input. Your experience matters and support remains a core element of their service ethos.

Final Thoughts

Choosing the right business account is crucial for managing your finances effectively. ANNA Money stands out with its innovative AI assistant and seamless integration of financial tools. Its user-friendly design and exceptional customer support make it a compelling choice. If you’re looking for a smart and secure way to handle your business finances, ANNA Money offers a blend of efficiency and advanced features that are hard to beat. Consider making the switch to experience the benefits firsthand.